child tax credit for december 2021 amount

The criteria on how receive a 1400 payment in 2022. Enhanced child tax credit.

Congress Must Act To Save The Expanded Child Tax Credit

For 2021 eligible parents or guardians.

. Have been a US. The credit amount was increased for 2021. The two most significant changes impact the.

The total credit is as much as 3600 per child. If you did not receive the stimulus for a. Your newborn should be eligible for the Child Tax credit of 3600.

Last updated April 05 2022. Unless Congress takes action the 2020 tax credit rules apply in 2022. The Earned Income Tax.

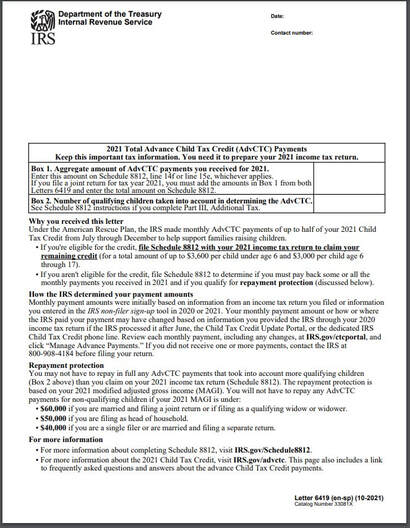

The 2021 CTC is different than before in 6 key ways. However the deadline to apply for the child tax credit payment passed on November 15. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

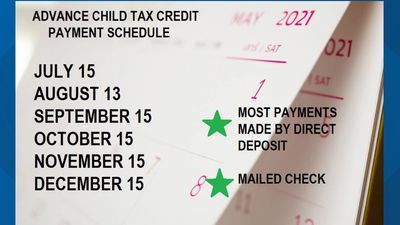

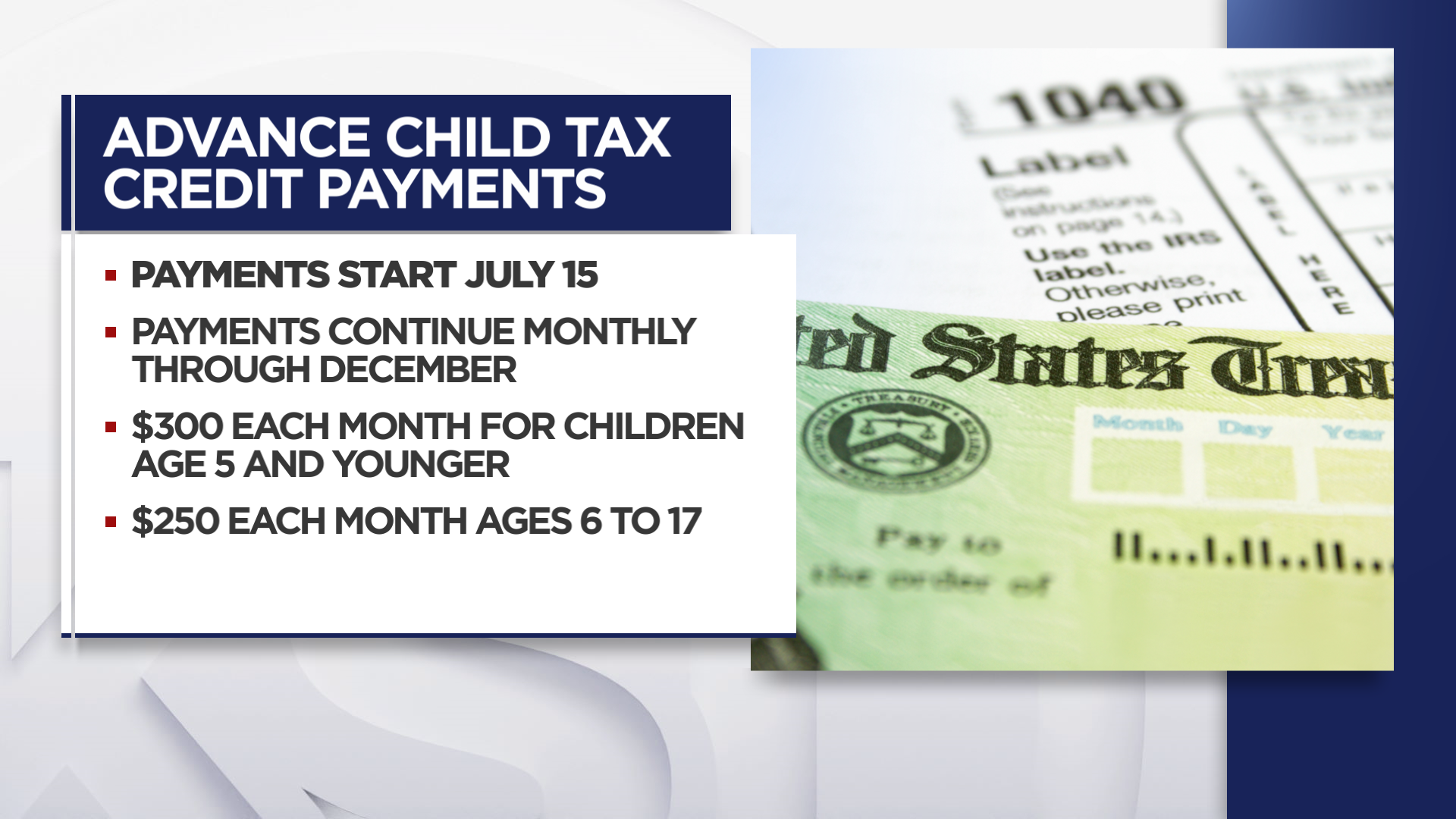

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. 21 hours agoFor the 2023 tax year the standard deduction amounts are as follows. The IRS pre-paid half the total credit amount in monthly payments from.

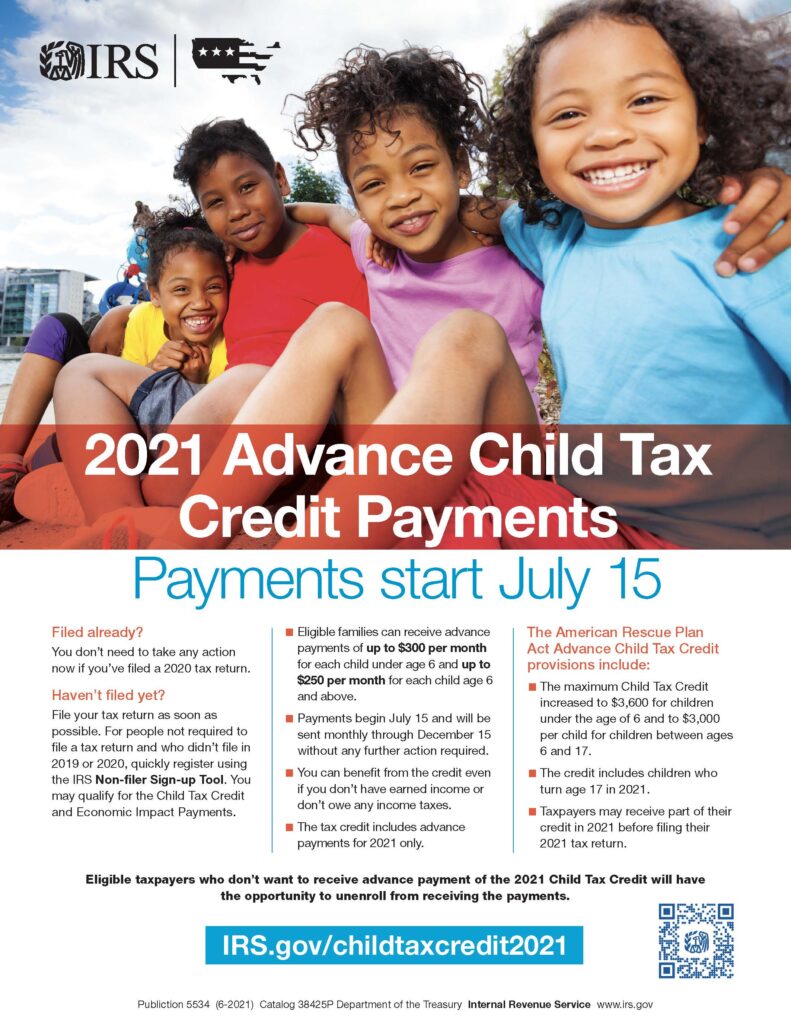

You can get more when you file. Your newborn child is eligible for the the third stimulus of 1400. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

To get assistance filing for the Child Tax Credit click here. Big changes were made to the child tax credit for the 2021 tax year. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Heres an overview of what to know. 1200 sent in April 2020.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. A childs age determines the amount. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

But you are still able to receive the full amount of the 2021 Child Tax Credit. If youre at least 65 years old or blind you can claim an additional standard deduction of 1500 in 2023. Increases the tax credit amount.

A childs age helps determine the amount of Child Tax Credit that eligible parents or. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. Arents in the United States who received Child Tax Credit payments in 2021 should look out for a letter in the.

The enhanced child tax credit expired at the end of December. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. These updated FAQs were released to the public in Fact Sheet 2022.

The amount changes to 3000 total for each child ages six through 17 or 250 per. The tax credits maximum amount is 3000 per child and 3600 for children under 6. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. By The Kiplinger Washington Editors. The credit amounts will increase for many.

Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021.

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit Payment Schedule For 2021 Kiplinger

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

How To Get Up To 3 600 Child Tax Credit Now Michael Ryan Money

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Advance Child Tax Credit Payments Anfinson Thompson Co

December S Child Tax Credit Payment Is The Last One Unless Congress Acts Cnnpolitics

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Adv Child Tax Credit Cwa Tax Professionals

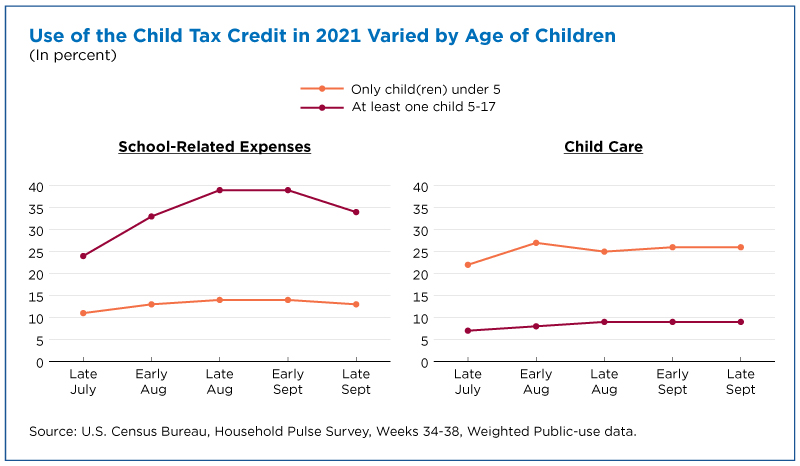

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Advance Child Tax Credit Tax Attorney Rjs Law San Diego